If you haven’t heard of Pay-As-You-Drive insurance by now, you’d be forgiven for missing the boat. Despite being what sounds like an innovative and more accurate way of insuring people based on their needs and their risk, Pay-As-You-Drive insurance policies have been around for a while yet have struggled to take hold.

Do we all use our cars too much for it to be worth buying prepaid insurance, or are we simply all stuck in our ways and resisting change? Since the first of these types of policies came out, over half a dozen major insurers have piloted and discontinued them, citing a number of varying reasons.

Currently, products like these are available from Progressive Insurance, Liberty Mutual, MileMeter and GMAC in the United States.

What is Pay-As-You-Drive Insurance?

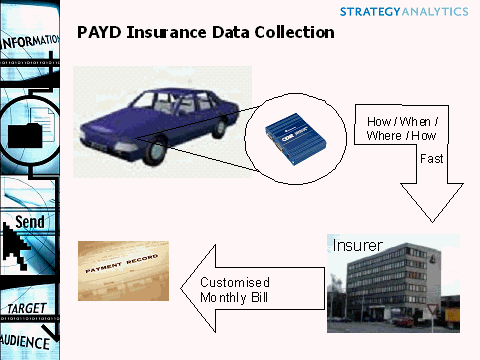

PAYD insurance is simply a pre-paid insurance policy that charges you based on either the number of miles you drive, how many minutes you use your car for, or when you use it. It can also penalize you for driving badly or recklessly, and reward you more effectively for being safer. But how does it know all of this?

PAYD insurance policies require the installation of a GPS tracking unit in a ‘black box’ component. This box records certain information about your car while you drive it, allowing insurance companies to charge you based on your driving habits. There are three main types of pay-as-you-drive insurance:

- Coverage based purely on mileage

- Coverage based on the number of minutes you use your car for

- Coverage based on driving style

Some insurance policies make use of more than one of these metrics to determine how much you are charged. In most cases, however, you top up a ‘pre-paid’ balance, from which your insurance ‘premiums’ are deducted every month or week.

Obviously, this type of insurance benefits those who drive less than the average. This is because conventional auto insurance policies are charged based on an average for your group and vehicle’s risk profile, and not tailored to your individual driving habits. You might be under 25 and drive a red hot sports coupe, but you only spend 40 minutes in it a day driving on quiet roads to college.

Under a normal insurance policy you probably wouldn’t be able to afford the insurance on this car, but under pay-as-you-drive it could become very affordable.

The Benefits of PAYD

PAYD insurance obviously has a number of benefits for people who don’t use their cars as much as the average commuter. It works out well for people who work from home, or students who are able to walk to class but need their car primarily on weekends.

Prepaid insurance is also extremely popular with environmental lobbyist groups, as it promotes using your vehicle less often, and taking public transport when possible. Overall if you use this type of insurance, and make a conscious effort to use your car as little as possible, it can enable you to reduce your insurance premiums significantly.

And the Downside is…

There are a few negatives to this type of insurance, mostly related to technical niggles that haven’t quite been worked out yet. These include:

- Slow uptake of the ‘black box’ technology amongst manufacturers and retailers. It remains expensive for insurance companies to have these devices manufactured and installed, and so this can artificially inflate the cost of the policies.

- The devices themselves aren’t that ‘smart’ yet. They can record the number of miles you drive, when you drove them, your fuel consumption and how fast you were going, but these aren’t all the numbers you need to make informed decisions about your risk. For example a driver who speeds but otherwise drives safely would be charged more than one who stuck to the speed limit but drove carelessly.

- These types of products measure future risk only, not past risk. While this may not mean much to most consumers, it means that insurance companies are at a loss when it comes to deciding on exactly how much people should be charged. This often works out badly for the insurance companies, and could go some way to explaining why these products tend to live for only a few years before being taken off the shelf.

- PAYD insurance usually requires some kind of ‘black box’ component, which some drivers object to as an invasion of privacy.

Mixed Feelings

These types of policies look like they make (mostly) good deals for drivers, so why are they so few and far between? It’s possibly because they are too much of a good deal, and insurers have trouble footing the bill.

The UK’s largest insurer, Norwich Insurance, has recently pulled its Pay-As-You-Drive product from the shelves. They cited poor take up, and blamed this on poor uptake by manufacturers and little support in getting their devices installed into vehicles.

This is a shame for previous customers of the service, one of whom, Clare from Preston, estimates she was saving up to $50 a month.

“I might have to change companies, it depends on how much they’re going to quote me,” she said. “I’ll be sad to see it go, it saves young people like me money,” she added.