Alabama Auto Insurance Requirements

Alabama Auto Insurance Requirements

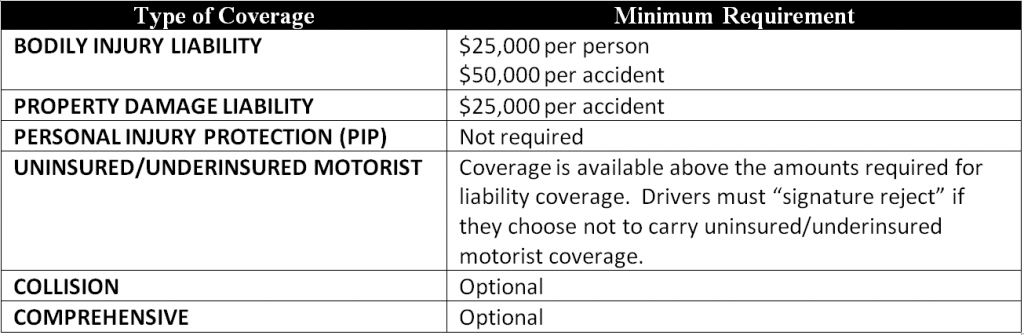

Every driver in Alabama is legally required to be covered by car insurance or equivalent. Specifically, Alabama auto insurance law requires drivers to carry a current liability insurance policy or a motor vehicle liability bond, or maintain a deposit of cash with the state treasurer..Personal injury protection (PIP or “no-fault”) car insurance is not available in Alabama. Requirements for minimum auto insurance coverage (or alternatives) in Alabama are mandated by the Alabama Department of Revenue, Motor Vehicles Division. Motorists are required to have the following minimum coverage on every vehicle:

(Source: Department of Revenue, Motor Vehicles Division)

Driving without the mandatory liability insurance, bond or deposit in Alabama will result in a license plate suspension. The license reinstatement fee for a first offender is $200, plus proof of current car insurance. Civil fines of up to $400, plus a four-month suspension of the driver’s license can be imposed for second and subsequent violations. Court costs may also be levied, depending upon the jurisdiction.

Drivers not wishing to carry car insurance in Alabama may either deposit $50,000 with the state treasurer, or obtain a $50,000 liability bond.

Factors Influencing Car Insurance Premiums in Alabama

Finding cheap car insurance in Alabama is an easier task than in many other states, as Alabama ranks 37th in average car insurance costs. While there are a variety of factors that go into underwriting auto insurance, Alabama insurance laws give good drivers the opportunity to qualify for cheap car insurance in comparison to other states.

The average cost of auto insurance in Alabama is about $650. Compared to the rest of the country, Alabama insurance costs are on the cheap side. The state ranks 34th for most expensive insurance, out of the 50 states and D.C. (Source: Insurance Information Institute).

Tips for Obtaining Cheap Car Insurance in Alabama

- Take a defensive driving course. Many insurers offer a 5% to 10% policy discount after completing such a course. Defensive driving courses are available from private driving schools as well as government organizations such as Huntsville Municipal Court.

- Maintain a good driving record

- Ask about discounts for college graduates and good students

- Bind multiple policies (homeowners, life, auto) with the same provider

- Maintain good credit score

- Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly. That is, if you have $1,000 saved in an emergency fund, go ahead and increase your auto insurance deductible to $1,000. A higher deductible should result in lower monthly payments.

- Discuss affinity discounts with your insurance provider

- Drop comprehensive and collision insurance on older vehicles that are paid off and are worth less than $1,000

Alabama Statistics

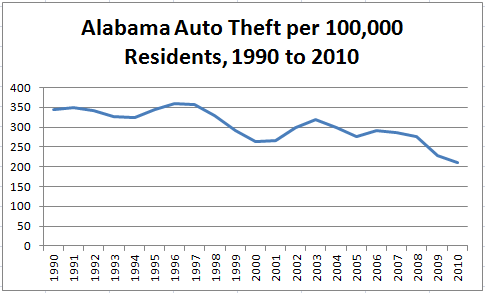

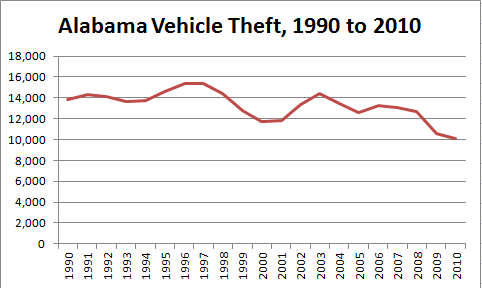

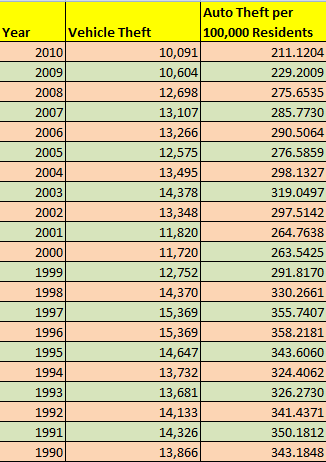

Auto Theft: Perhaps surprisingly, Alabama enjoys one of the lower rates of auto theft in the nation, and the rate has been decreasing consistently over the past 20 years.

(Sources: Alabama Criminal Justice Information Center and the U.S. Census Bureau)

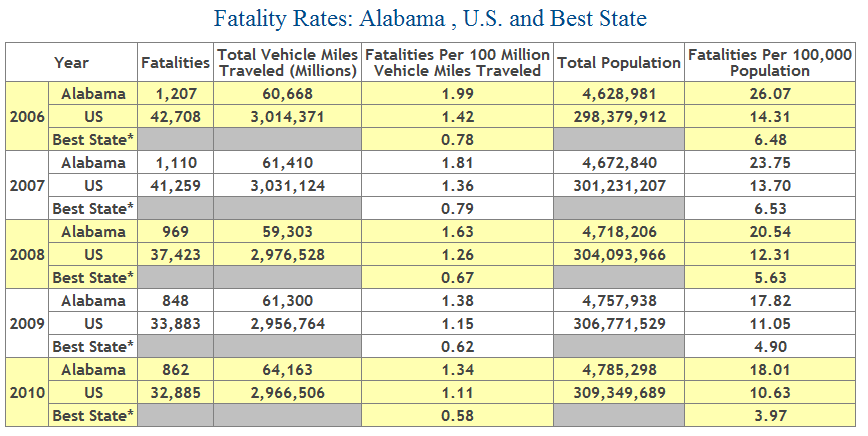

Automobile Accidents: Total vehicle miles traveled in Alabama have decreased in recent years, as have the number of fatalities on Alabama roads. Fatal car crashes increased slightly in 2010, but are on an overall downward trend over the past five years:

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Alabama.