Montana Auto Insurance Requirements

Montana Auto Insurance Requirements

Reviewed by Dr. Christine Berry

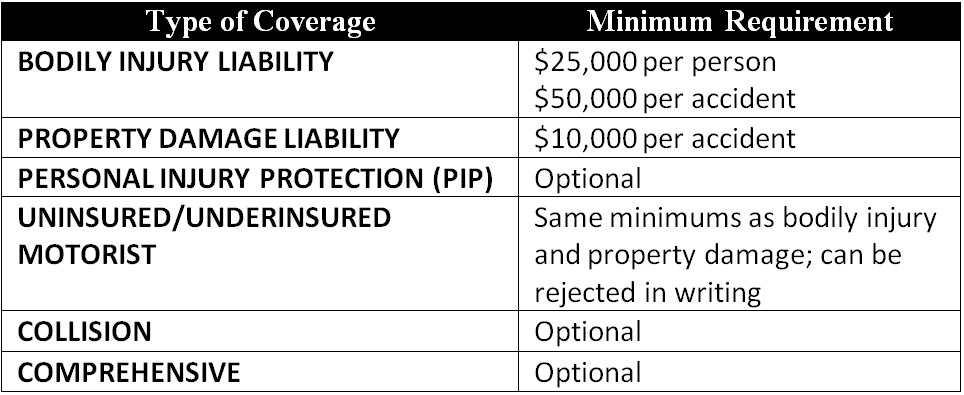

Montana financial responsibility requirements are mandated by state law and the Montana Commissioner of Securities and Insurance. When insurance is used to meet financial responsibility requirements, the following minimum coverage is required on every registered vehicle:

(Source: Montana Commissioner of Securities and Insurance)

Financial responsibility can also be met by filing a surety bond or depositing $55,000 in cash or securities with the state treasurer.

Driving without meeting the Montana financial responsibility laws will result in five conviction points on your driver’s license.

The Montana Automobile Insurance Plan is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the AIPSO website.

Factors Influencing Car Insurance Premiums in Montan

Montana ranks as one of the highest states in the nation for car insurance costs. Some factors that impact insurance rates in Montana include:

– Vehicle repair costs are generally more expensive in Montana than elsewhere

– Overall accident fatality rates are well above national averages

– A percentage of uninsured drivers that is near national averages

– Vehicle theft rates near national averages

The average auto insurance premium for residents in Montana is $655.

Tips for Obtaining Cheap Car Insurance in Montana

If you’re over 55, Montana law requires insurers give you a premium reduction if you take a state-approved defensive driving

– Some insurance companies offer “pay as you drive” car insurance for low mileage drivers in Montana; others will give discounts simply for driving less than 7,500 miles per year

– Ask whether the insurer gives discounts for an anti-theft device, automatic seatbelts, and/or airbags

– If you carpool and drive to work less than two days a week, some companies may offer you a discount in Montana

-Maintain a good driving record

– Ask about discounts for college graduates and good students

– Bind multiple policies (homeowners, life, auto) with the same provider

– Maintain good credit score

– Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly

– Discuss affinity discounts with your insurance provider

– Drop comprehensive and collision insurance on older vehicles that are paid off and are worth less than $1,000

Montana Statistics

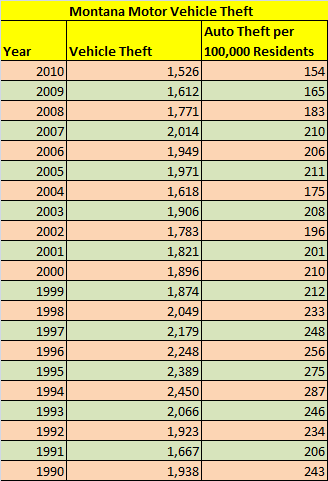

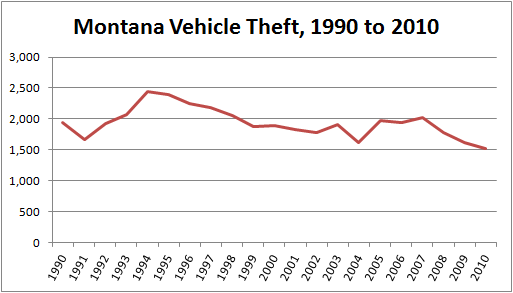

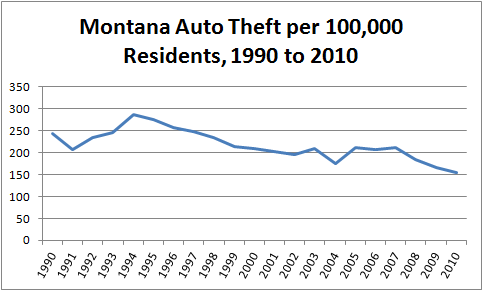

– Auto Theft: Montana has a relatively high vehicle theft rate, but it has been decreasing (as is the case in most states) consistently over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Montana Department of Justice, Motor Vehicle Division)

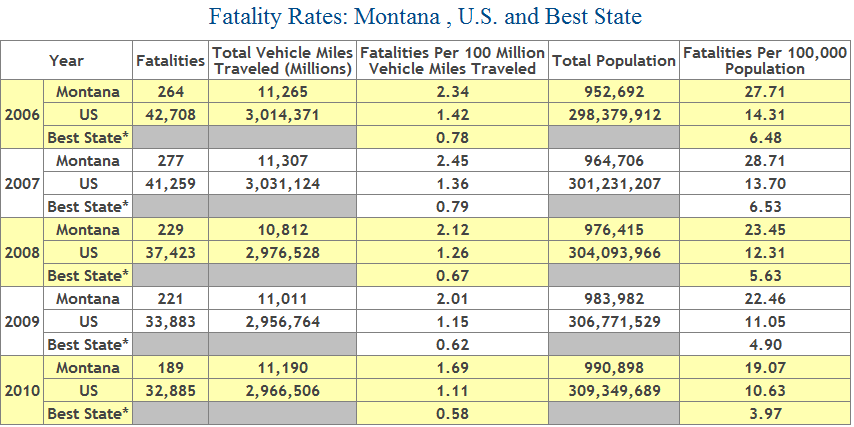

– Automobile Accidents: The total vehicle miles traveled in Montana has remained fairly consistent in recent years, but vehicle accident fatality rates have declined somewhat. Still, Montana is well above the national average in numbers of deaths in car crashes.

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Montana.