Idaho Auto Insurance Requirements

Idaho Auto Insurance Requirements

Reviewed by Dr. Christine Berry

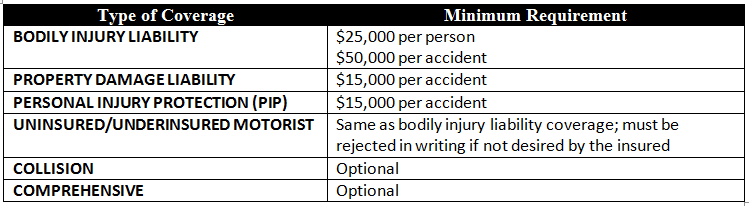

Idaho has financial responsibility requirements mandated by the Idaho Department of Insurance. Motorists in Idaho may elect to meet these requirements by carrying auto insurance, or by posting a bond with the state. The following minimum coverage is required on every registered vehicle, except as noted below:

(Source: Idaho Department of Insurance)

Driving without meeting the financial responsibility requirements in Idaho will result in a $75 fine for the first offense; subsequent offenses within a five year period are a misdemeanor with a fine of up to $1,000, suspension of driving privileges, and up to a six month jail term.

Motorists in Idaho may, in lieu of an auto insurance policy, post a surety bond with the Idaho Department of Insurance ranging from $50,000, all the way up to $120,000 for drivers with five or more vehicles.

The Idaho Automobile Insurance Plan is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the AIPSO website.

Factors Influencing Car Insurance Premiums in Idaho

Getting a quote for cheap car insurance in Idaho requires research and rate comparisons between different insurance companies, even though Idaho ranks among the least expensive states for car insurance costs. Some factors that impact insurance rates in Idaho include:

– Idaho has a relatively low population density and has less cars on the road as a result

– Vehicle repair costs are generally more expensive in Idaho than elsewhere

– A lower percentage of uninsured drivers compared to national averages

– Vehicle theft rates well below national averages

The average auto insurance premium for residents in Idaho is $555, which is significantly lower than the national average of $785.

Tips for Obtaining Cheap Car Insurance in Idaho

– If you’re over 55, take a state-approved defensive driving course for a policy discount

– Some insurance companies offer “pay as you drive” car insurance for low mileage drivers in Idaho

– Move to the suburbs; Idaho law allows companies to base your rates on where you live (gargage your car) even if you drive your car into more urban areas (e.g. where you work) – rates are lower in urban areas

– Eliminate duplicate coverages, e.g. do not purchase “Medical Payments” coverage if you have good health insurance

– Call an insurance agent and ask about the cost of auto insurance on a vehicle before you buy the car; sports cars and high-performance cars tend to get into more accidents so the insurance on them is generally more expensive

Idaho Statistics

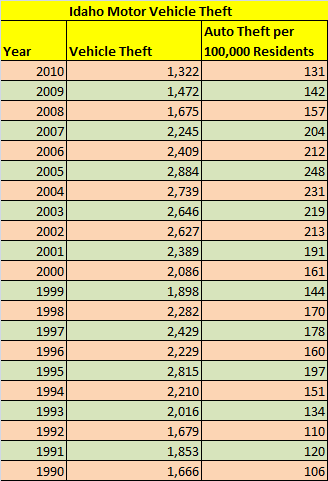

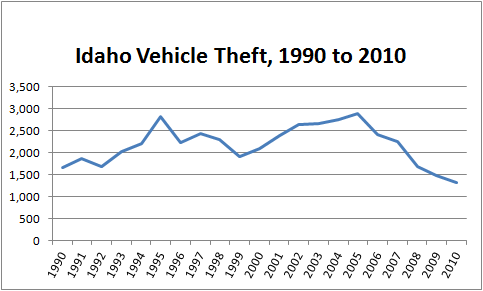

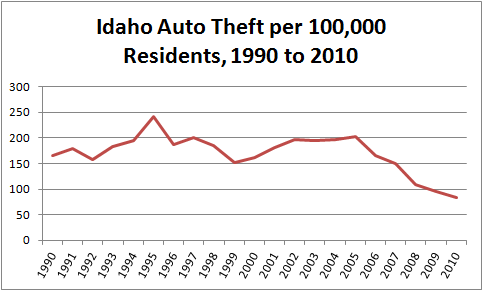

– Auto Theft: Idaho has one of the lower auto theft rates in the nation. However, perhaps because of its initially low theft rate, Idaho has not seen the same sharp declines in auto theft that have been prevalent in most other states over the past decade.

(Source: Idaho State Police)

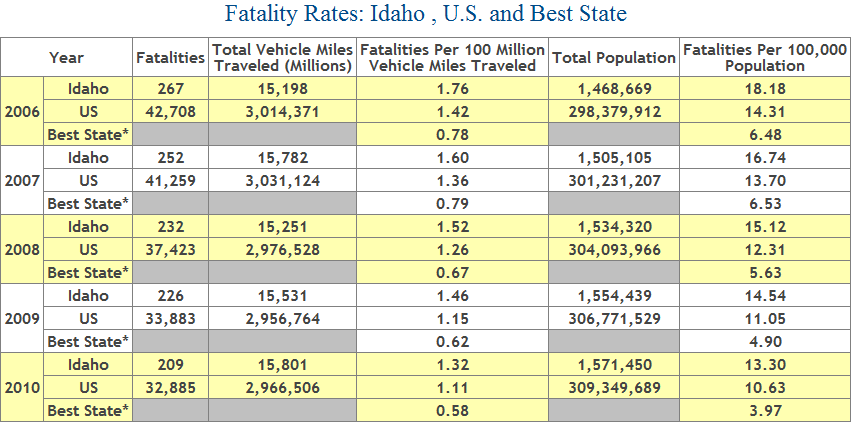

– Automobile Accidents: The total vehicle miles traveled in Idaho has remained almost constant, as have vehicle accident fatality rates. Idaho has one of the lowest numbers of deaths in car crashes in the country, despite having a fairly high population concentration.

(Source: National Highway Traffic Safety Administration)

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Idaho.