Maryland Auto Insurance Requirements

Maryland Auto Insurance Requirements

Reviewed by Dr. Christine Berry

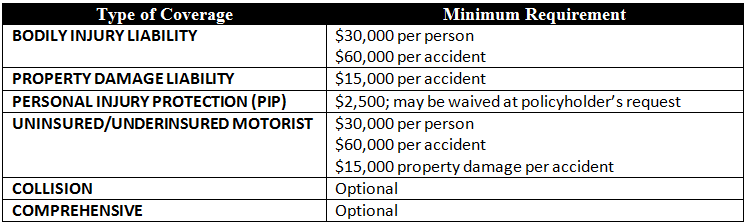

Maryland takes a very tough stance on mandatory auto insurance laws for both private and commercial vehicle owners. Minimum auto insurance coverage requirements in Maryland are mandated by state law and the Maryland Motor Vehicle Administration. The following minimum coverage is required on every registered vehicle:

(Source: Maryland Motor Vehicle Administration and Maryland Insurance Administration)

Driving without the mandatory liability insurance in Maryland can result in loss of license plates and vehicle registration privileges. Offenders must pay uninsured motorist penalty fees for each lapse of insurance – $150 for the first 30 days, $7 per day thereafter up to a maximum of $2,500.

The Maryland Automobile Insurance Fund is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the MAIF website.

Factors Influencing Car Insurance Premiums in Maryland

Getting a quote for cheap car insurance in Maryland requires some research and rate comparisons between different insurance companies, even though Maryland ranks just above national averages for car insurance costs. Some factors that impact insurance rates in Maryland include:

– Urban congestion in the eastern part of the state means many more vehicles on the road, more accidents, and more claims

– Vehicle repair costs are generally more expensive in Maryland than elsewhere

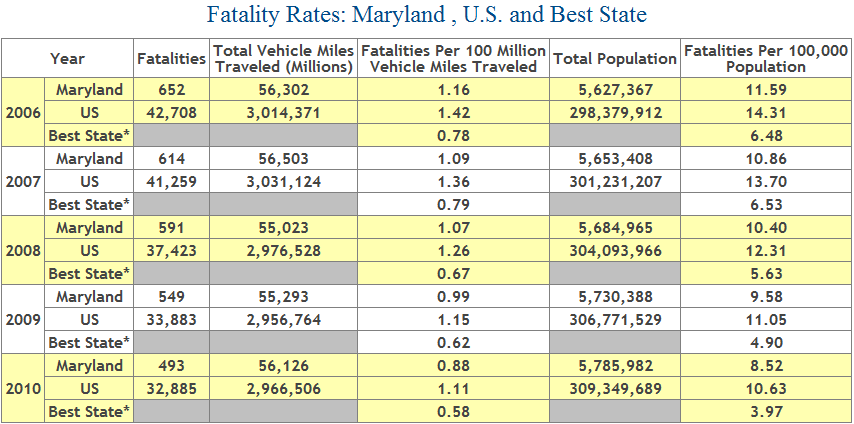

– Overall accident fatality rates are lower than national averages

– A much higher percentage of uninsured drivers compared to national averages

– Vehicle theft rates near national averages

With an average annual expenditure of $929, Maryland’s average auto insurance premiums are the 10th most expensive in the nation.

Tips for Obtaining Cheap Car Insurance in Maryland

– Some insurance companies offer “pay as you drive” car insurance for low mileage drivers in Maryland

– Ask about financing and installment plans as well as installment fees

– If you have a bad credit history and are working to improve it, you have a legal right to have your insurer check your credit history after a one year period

– You might be able to get discounts for safety and anti-theft devices

– Look for discounts for being a member of a shopper’s club, an alumni group, or a credit union or being a teacher, a state employee or in the military

– You may elect to waive the PIP coverage; this may be advisable if you have good health insurance coverage elsewhere

Maryland Statistics

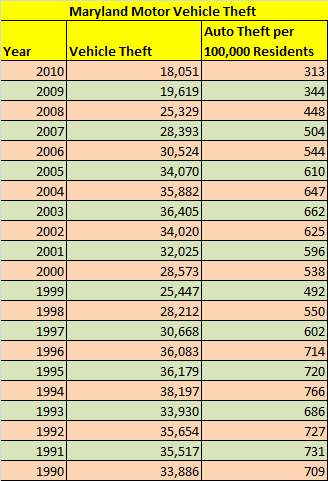

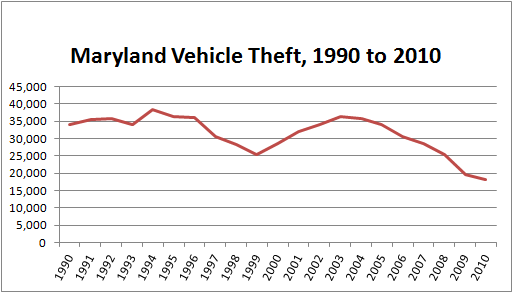

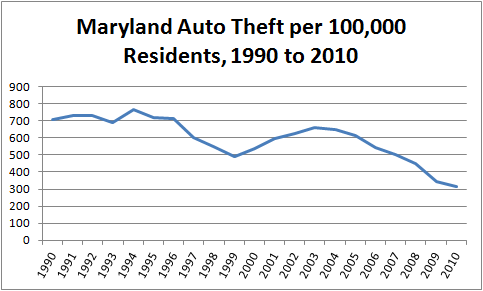

– Auto Theft: Maryland has one of the highest rates of vehicle theft in the country, but it has been decreasing (as is the case in most states) consistently over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Maryland Governor’s Office of Crime Control and Prevention)

(Source: Maryland Governor’s Office of Crime Control and Prevention)

– Automobile Accidents: The total vehicle miles traveled in Maryland has decreased slightly in recent years, and vehicle accident fatality rates have declined as well. Maryland is below the national average in numbers of deaths in car crashes, despite having a fairly high population concentration, particularly in the eastern part of the state.

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Maryland.