Mississippi Auto Insurance Requirements

Mississippi Auto Insurance Requirements

Reviewed by Dr. Christine Berry

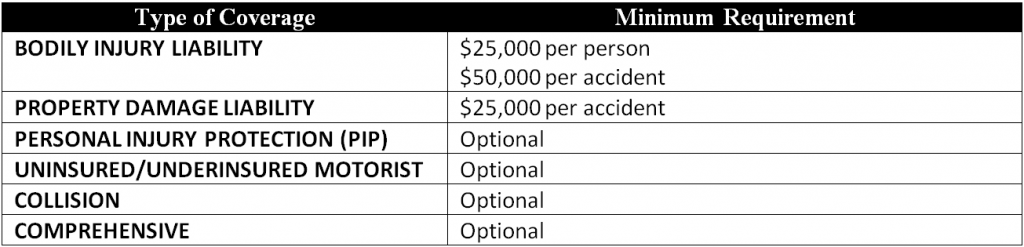

Mississippi is in the process of enacting a robust system for verifying that all drivers are covered by auto insurance. Minimum auto insurance coverage requirements in Mississippi are mandated by state law and the Mississippi Insurance Department. The following minimum coverage is required on every registered vehicle, except as noted below:

(Source: Mississippi Insurance Department)

Alternatively, drivers of registered vehicles can post a bond or make a cash or security deposit with the state in the same amounts as the insurance required.

For the first offense, driving without the mandatory liability insurance in Mississippi will result in a $1,000 fine and suspension of driving privileges for one year or until financial responsibility can be shown.

The Mississippi Automobile Insurance Plan is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the AIPSO website.

Factors Influencing Car Insurance Premiums in Mississippi

Getting a quote for cheap car insurance in Mississippi requires some research and rate comparisons between different insurance companies, since Mississippi ranks as one of the most expensive states for car insurance costs. Some factors that impact insurance rates in Mississippi include:

– Vehicle repair costs are generally less expensive in Mississippi than elsewhere

– Overall accident fatality rates are much higher than national averages

– Mississippi has the highest estimated percentage of uninsured drivers (28%) in the country.

– Vehicle theft rates above national averages

The average auto insurance premium for residents in Mississippi is $738.

Tips for Obtaining Cheap Car Insurance in Mississippi

– If you’re over 55, take a state-approved defensive driving course for a policy discount

– Some insurance companies offer “pay as you drive” car insurance for low mileage drivers in Mississippi

– Ask about discounts on equipment in your care such as anti-lock brakes, anti-theft devices, air bags, and automatic seat belts; these discounts average 5% in Mississippi

– Pay your insurance in a timely manner because it will be harder to find inexpensive coverage in Mississippi once you have been cancelled for non-payment

– Check into the cost of auto insurance on a vehicle before you purchase it

-Maintain a good driving record

– Ask about discounts for college graduates and good students

– Bind multiple policies (homeowners, life, auto) with the same provider

– Maintain a good credit score

– Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly

– Discuss affinity discounts with your insurance provider

– Drop comprehensive and collision insurance on older vehicles that are paid off and are worth less than $1,000

Mississippi Statistics

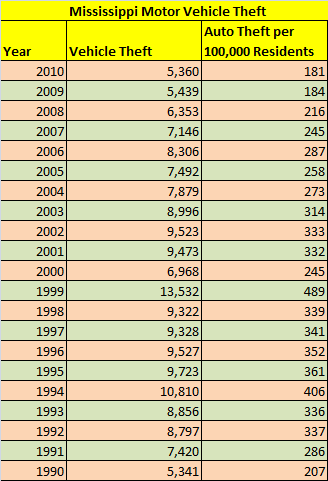

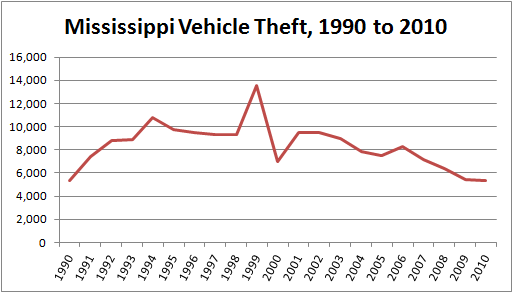

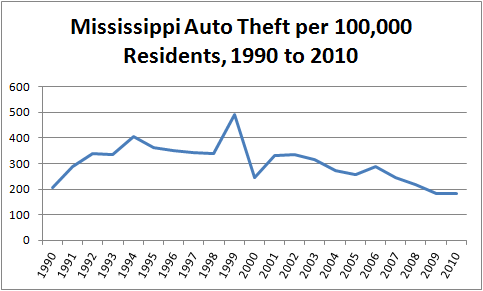

– Auto Theft: Mississippi has a relatively high vehicle theft rate, but it has been decreasing (as is the case in most states) consistently over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Mississippi Bureau of Investigation)

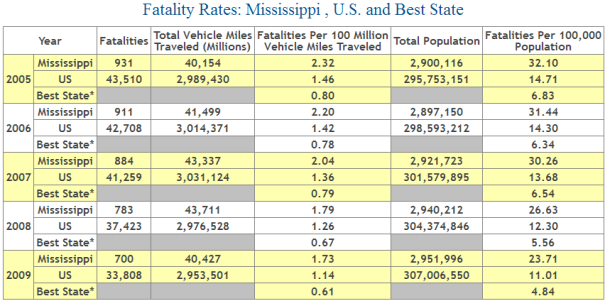

– Automobile Accidents: The total vehicle miles traveled in Mississippi decreased significantly between 2008 and 2009, but vehicle accident fatality rates have remained fairly constant. Mississippi is well above the national average in numbers of deaths in car crashes.

(Source: National Highway Traffic Safety Administration)

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Mississippi.