Handing over the keys to your newly-qualified teen driver is not a moment most parents look forward to. It does mean that you no longer have to cart them around, but it also means that they are all of a sudden open to a great many risks on the road, and all of a sudden have a much higher chance of dying or being seriously injured, when you have no ability to protect them.

Handing over the keys to your newly-qualified teen driver is not a moment most parents look forward to. It does mean that you no longer have to cart them around, but it also means that they are all of a sudden open to a great many risks on the road, and all of a sudden have a much higher chance of dying or being seriously injured, when you have no ability to protect them.

Along with these concerns comes the cost of insurance, which can often keep younger drivers off the road for a few years after they get their licenses. On the one hand you have teens and parents complaining that they, as the people with the lowest earning potential, have to pay the highest rates for insurance. On the other hand you have the insurance companies, who simply point to a spreadsheet of numbers, and give you the bill.

Facts About Younger Drivers’ Risk

A lot of people complain that insurance companies come down unnecessarily hard on younger drivers, but the numbers say otherwise. Here are a few chilling facts about younger drivers. Most of these come from 2009 statistics, as 2010 numbers have not yet been released at time or writing.

Also note that “younger drivers” here is taken to mean drivers between the ages of 16 and 25 (inclusive).

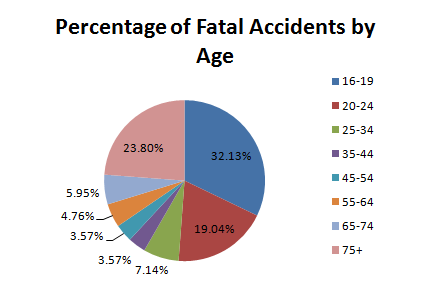

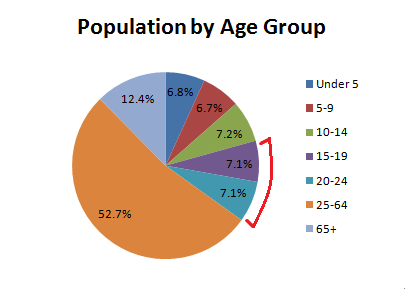

- Drivers aged 16-25 are responsible for 30% of motor vehicle accident damage, despite representing only 14% of the American population as you can see from the graphics below.

Note: the percentage of accidents looks bigger, because age groups that are not driving are not included.

- In 2009 around 3,000 teenagers were killed in car accidents, and over 350,000 were treated for serious injuries. To put it in perspective, that’s the entire population of Eugene, OR.

- 1 in every 44 people were in an accident in 2009. If younger drivers made up 30% of these accidents, that means your child has a roughly 1 in 120 chance of being in a serious car accident every year.

- Drivers 16-19 are four times more likely to crash per mile driven than drivers over 20

- Teens face increased risks of crashing with the more teen passengers they have with them in the car (especially male passengers, who are known to encourage risky behavior)

- 32% of accidents (across all age groups) involved alcohol-impaired drivers

It’s All the Boys’ Fault

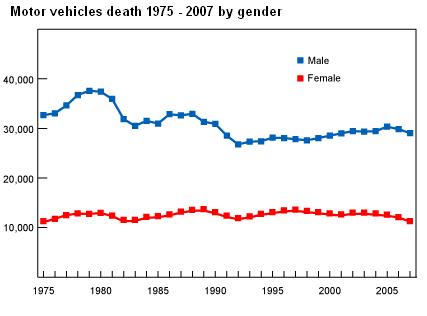

Say what you like about the bad female driver stereotype, but the numbers say otherwise – as you can see by this simple graphic:

Young males are far more risk-prone, and engage in deliberately risky driving almost twice as often as females. Here are a few interesting facts about boys and their toys:

- Male high school students (12.5%) were more likely than female students (7.8%) to rarely or never wear seat belts

- Teens are more likely than older drivers to speed and allow shorter headways (the distance from the front of one vehicle to the front of the next). The presence of male teenage passengers increases the likelihood of this risky driving behavior. (Simons-Morton B, Lerner N, Singer J. 2005)

- Males aged 16-19 are twice as likely to crash as females of the same age group

Factors Influencing Safety Among Teen Drivers

Aside from the above statistics, the Center for Disease Control and Prevention lists a number of reasons why teen drivers are at much higher risk. The reasons are many, but can be summed up by the following list of risky behaviors ascribed to younger drivers

- Drinking and driving

- Driving with male passengers

- Speeding

- Not allowing enough headway

- Mobile phone use while driving

- Night driving

Things You Can do to Increase Teen Drivers’ Safety (and Reduce Their Insurance Premiums)

When you tell an insurance company that you are under 25, there isn’t a lot you can do to bring the number they quote you down. However, that doesn’t mean it’s the be-all and end all. Just like there are ways to improve your safety, there are things you can do to reduce your premiums.

General Safety

- Prevent your teens from night driving until you are comfortable with their driving ability

- Limit them to only one passenger

- Educate them about driving under the influence, and also about driving with a hang-over (inconclusive studies have claimed that this is possibly even more dangerous)

Reducing Insurance Premiums

As well as helping your kids to be safer on the road, the following interventions can also help to reduce their insurance premiums:

- Send them on an advanced driving course. Some insurance companies offer to reduce premiums if you have completed a course that teaches teen drivers how to drive more safely, and react in dangerous situations. These courses can be associated with 30% less risk to teen drivers.

- Ensure that they drive a car with modern safety features

- Make sure they keep their grades up. This might sound strange, but a number of insurance companies are rewarding good students with lower premiums. The rationale is that students who study harder are generally more risk-averse. A GPA of 3.0 or higher will do the trick.

Insurance Fronting – How Not to Reduce Premiums

The one thing you cannot do, which is done far more often than insurance companies and the police would like, is to have the car insured under your own name, with them listed as a secondary driver.

While this might sound like good common sense, and save you a few hundred dollars a year on insurance, it is known as “Insurance Fronting”, and is considered to be insurance fraud. No state has “more flexible” laws about this than any other state, so don’t be fooled. It might save you a few dollars, but if caught out you could face massive penalties, or even time in prison.