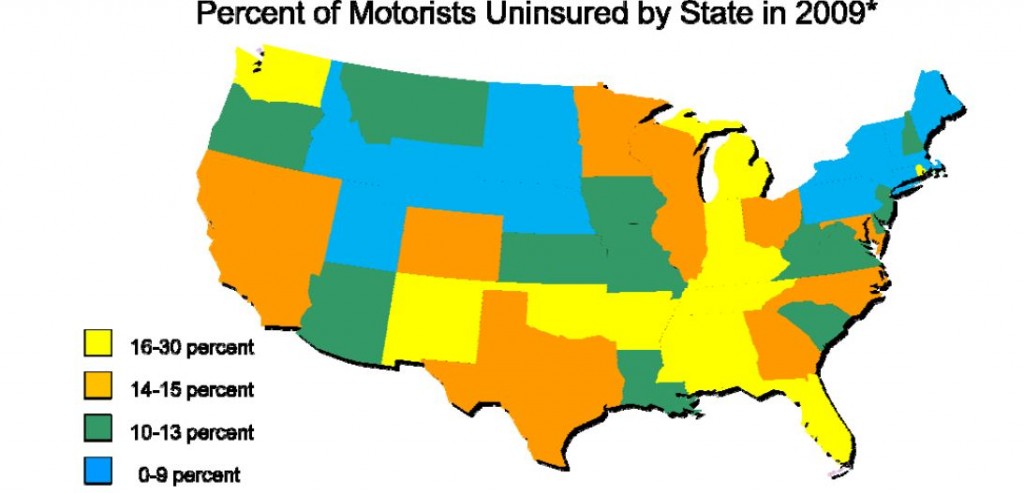

As you can see from the below graphic, your chance of being hit by an uninsured driver varies dramatically from state to state, and can be as high as 30% in some places:

As we have explained, there are two main types of car insurance that you can buy – fully comprehensive or third party insurance. If you have fully comprehensive insurance, then the steps are relatively simple: just follow the instructions in the article ‘How to Handle a Car Accident‘ and you should be absolutely fine.

Just make sure that you have:

- The other driver’s name, number and insurance details

- A witness who will allow you to take their statement (and their number)

- Pictures of the scene, if possible

- A police report

However, if you only have third party insurance, things can get a little bit more complicated. Third party insurance only protects you against claims made against you, for damage caused by you to another vehicle or property. It won’t pay for any repairs to your own vehicle.

If you have third party insurance only, here are a few things you can do if hit by an uninsured driver:

1) Handle the accident scene properly

This means that you need to do the following:

- Call your insurance company immediately. Have their number on your phone and get instructions from them before doing anything.

- Take photos of the accident with your phone if possible

- Get the other driver’s details

- Find a witness – someone who saw the accident – and take their number

- Call the police if the other person appears to have been drinking or taking drugs

2) Go to the police station

All insurance claims have to be accompanied by a police report. The quicker you do this, the easier it will be. If possible, get the other driver to come with you to the police station. Whatever you do, do not allow them to be the only person making a police report. They could very easily skew their report to make it look like the accident was your fault, and you will be entirely liable.

Once you have done those things, file a claim with your insurance company even if they will not pay it. It helps to keep an official record of the accident, in case a judge finds against you or your insurance company wants to increase your premium because of an accident that wasn’t your fault.

Once you’ve done those two things, you then have two options:

1) Lawyer up

This isn’t always the best option, as legal fees can be expensive and the judge is unlikely to award you costs as well as damages in any court case regarding an accident. However, if you have incurred significant damage to an expensive vehicle and medical expenses as well, it could be worth your while.

Of course, if the other person doesn’t have insurance, they are unlikely to have the funds or assets required to pay your damages as well.

One thing you can do is find a legal firm that promises no fees if they don’t win you a settlement. This can offset the cost of not getting a settlement to some degree.

2) Buy a new car

If your car was cheap and old, then it might just be more worthwhile to simply take the financial hit and buy a new, cheap car. It won’t feel good, but a court battle that leaves you breaking even and still having to buy a new car won’t feel any better, and will take longer.

In Hindsight You Should Have:

Hindsight is an exact science, and if you are reading this it is probably because you’ve already had the accident. However, if you haven’t yet, here are a few things you can do.

- Add ‘Uninsured Driver Cover’ to your policy. This is not available from all insurers, but many will offer it as an optional extra on third party cover. It is highly advisable to do so.

- Shop around for fully comprehensive insurance. If your car is worth more than 18 months’ worth of premiums, then it is almost certainly worth your while to try and fit this into your budget.